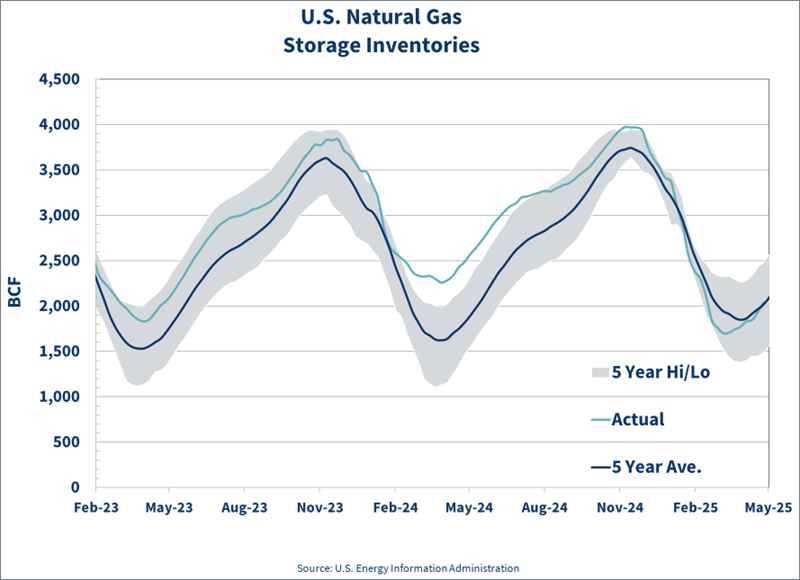

Warmer March weather allowed for injection season to start a few weeks early. April weather remained mild which brought storage levels very close to the 5-year average. The current expectation is that storage levels will rise above the 5-year average very soon. Economic pessimism and speculator activity have also played roles in the bearish market pressure we observed over the month of April.

The market over the last month has been very bearish, but with summer on the horizon and more LNG expected later this year, there is still a lot of upside risk in the futures market.

Gas Outlook

- Demand expected to outpace supply for the next 2 years.

- Early and strong injections pushed storage back above the 5-year average.

- Natural Gas markets still backwardated – 2026 close to trading highs and 2028 close to lows.

- New LNG terminal expected to come online in back half of 2025. More additions in 2026/2027.

Power Outlook

- ERCOT market inflated due to concerns around reserve margins, especially in further out years.

- CAISO and MISO prices trading near 24-month lows across all calendar strips.

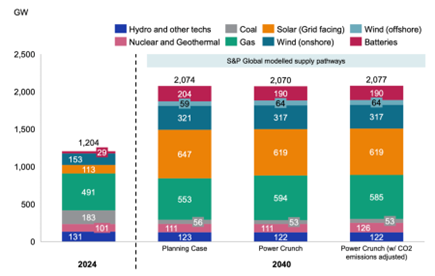

- Power demand expected to increase over the next 15 years driven heavily by new data centers, but increased solar and wind could capture most of the increase.

- MISO summer capacity prices cleared at $666.50/MW-Day in their most recent 2025/26 auction.

Driving Prices Higher

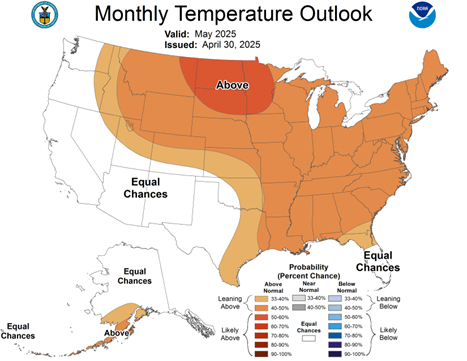

Speculator activity this week has driven prices higher. There have been more LNG exports since the beginning of the year, with another terminal expected to come online later this year. Meanwhile, production is remaining flat and is not expected to increase until new LNG terminals become operational. Warmer weather is expected in the next month, and prices typically rally right before summer in anticipation of increased demand.

Driving Prices Lower

Mild April weather, a faster-than-expected recovery in storage levels—now above the five-year average as of May 1st. Growing economic pessimism with expectations of reduced short-term demand, and recent pauses on new or increased tariffs are all contributing to continued downward pressure on prices.

Preparing for Future Energy Market Volatility

Mild spring weather has brought short-term relief, with storage nearing the five-year average. Ongoing market backwardation, flat production, and upcoming LNG terminal additions could add further price pressure. Power markets show similar trends. While CAISO and MISO are experiencing low prices, concerns over ERCOT’s reserve margins and growing data center demand may drive prices higher in the coming years.

Environ Market Analysts track and analyze millions of data points to help you reduce exposure to market swings, lower energy costs, and prepare for long-term price stability. For localized market analysis or information on scheduling an energy audit, email info@environenergy.com.