Sustainable Energy Solutions For Financial Institutions

How Can Environ Support Your Financial Mission?

It takes massive amounts of energy to keep the financial sector functioning as the central nervous system of the world’s economy. Resiliency is also essential, as natural disasters happen more often, and power outages can result in catastrophe. We support financial institutions with proven best practices and innovations in distributed energy resources (DER) to create a sustainable energy strategy with resiliency built in.

Resilience You Can Count On

To protect your operations, it’s critical to incorporate on-site power generation, sophisticated building automation, and microgrid technologies for energy certainty, cost savings, and new revenue streams. We deliver best-in-class active management based on innovative technologies, including fuel cells, CHP systems, and energy storage solutions.

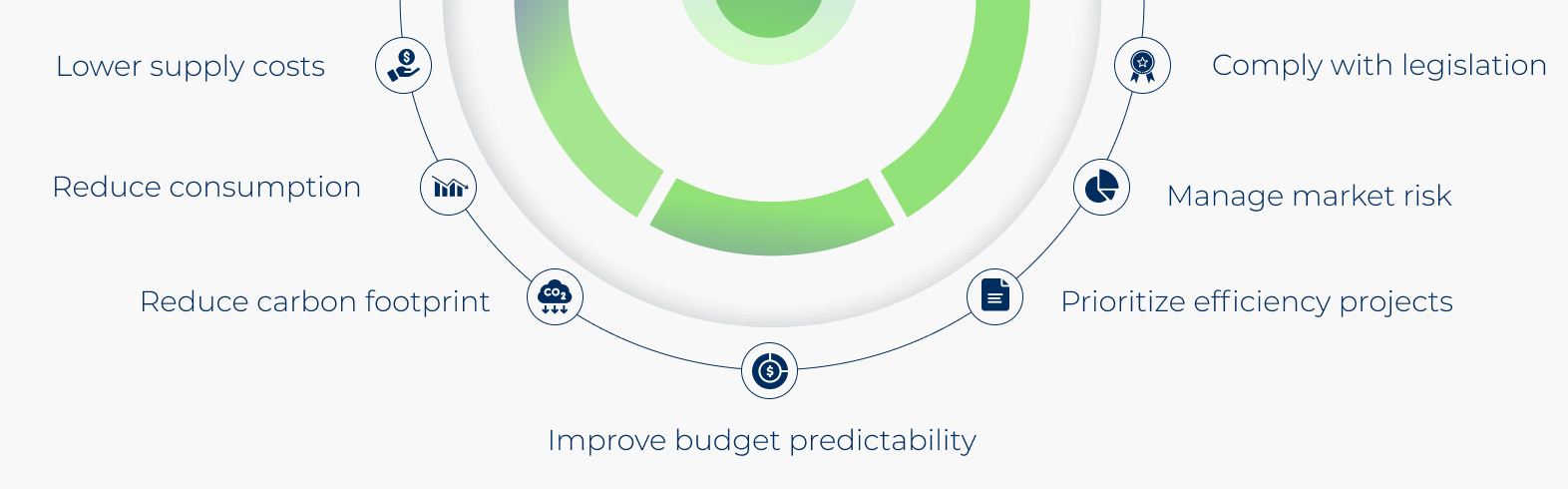

Only Environ delivers comprehensive and sustainable energy solutions that go beyond the limited one or two-pronged approach of other energy management consultants. Our veteran advisors have decades of experience in procurement, risk management, data analysis, decarbonization planning, and renewable energy sourcing. We take a full circle, connected approach and review your consumption, spend, and regulatory compliance requirements to drive positive results that other consulting firms can’t achieve.

Financial Services

Environ and Pennsylvania bank chain FNCB Bank reviewed the bank’s budgetary and sustainability goals and secured a supply contract of 100% green power through renewable energy credits (RECs). FNCB Bank pays for electricity generated from green sources, such as wind or solar as opposed to fossil fuel-based power. Environ also secured FNCB an EPA Green Power Partnership certification.

Environ Solutions:

- Energy Procurement

- Sustainability

Environ is very reliable when it comes to assessing electricity procurement for your facilities. They are honest about energy markets and whether the timing is favorable for your needs. This is the type of service you want from a provider, a team that truly cares what your vision is as a company and one that will recommend the best option for your future.

Tom Lunney

Senior VP, FNCB Bank

Get The Funds You Need For Your Highest Priorities

Through our Energy Incentive Management Solution, you gain access to capital and tax credits for investing in renewable energy projects and energy-efficient building upgrades. Our team helps you identify funding opportunities through rebates, grants, and incentives through state and localized government and utility programs.

Explore Related Services

Map Your Plan To Carbon Neutrality

Decarbonization Planning

Facility Assessments

Energy & Carbon Reduction

Project Funding

Enhance Energy Efficiency & Resiliency

Renewable Energy Systems

Energy Audits

Infrastructure Inventory

Central Plan Electrification Analysis

Use Reporting & Analytics

Climate Action Plans

ESG Ratings & Rankings

Scope 1, 2, & 3 Tracking & Reporting

Investor & Stakeholder Reports

Navigate Complex Regulations

Greenhouse Gas Inventory

Building Performance Standards

Carbon Legislation

ESG Disclosure

Buy The Right Energy Mix

Electricity

Natural Gas

Renewable Energy Credits (RECs)

Carbon Offsets