The intricate dance of Independent System Operator New England (ISO-NE) futures for the upcoming winters paints a nuanced picture of New England’s energy future. Winter 2023-24 sees a plunge, mirroring the natural gas trajectory but with interesting divergences.

Recent developments and joint statements from the Federal Energy Regulatory Commission (FERC) and the North American Electric Reliability Corporation (NERC) have brought the spotlight to the Everett LNG import terminal. The FERC is a federal regulatory agency overseeing energy markets and infrastructure, while NERC is a nonprofit organization focused on ensuring the reliability of the North American power grid through the development and enforcement of reliability standards. The two entities collaborate to maintain the stability and security of the electricity system.

This united stance underlines the pivotal role this terminal plays, cautioning against its closure due to potential catastrophic impacts on both energy reliability and affordability. The FERC and NERC CEOs emphasize the pivotal role of the Everett LNG import terminal, cautioning against its closure due to potential catastrophic impacts on energy reliability and affordability. ISO-NE projections suggest the region might cope without it, but the removal of a key natural gas supply resource could exacerbate supply availability issues, especially during peak demand.

Understanding the Winter Dynamics:

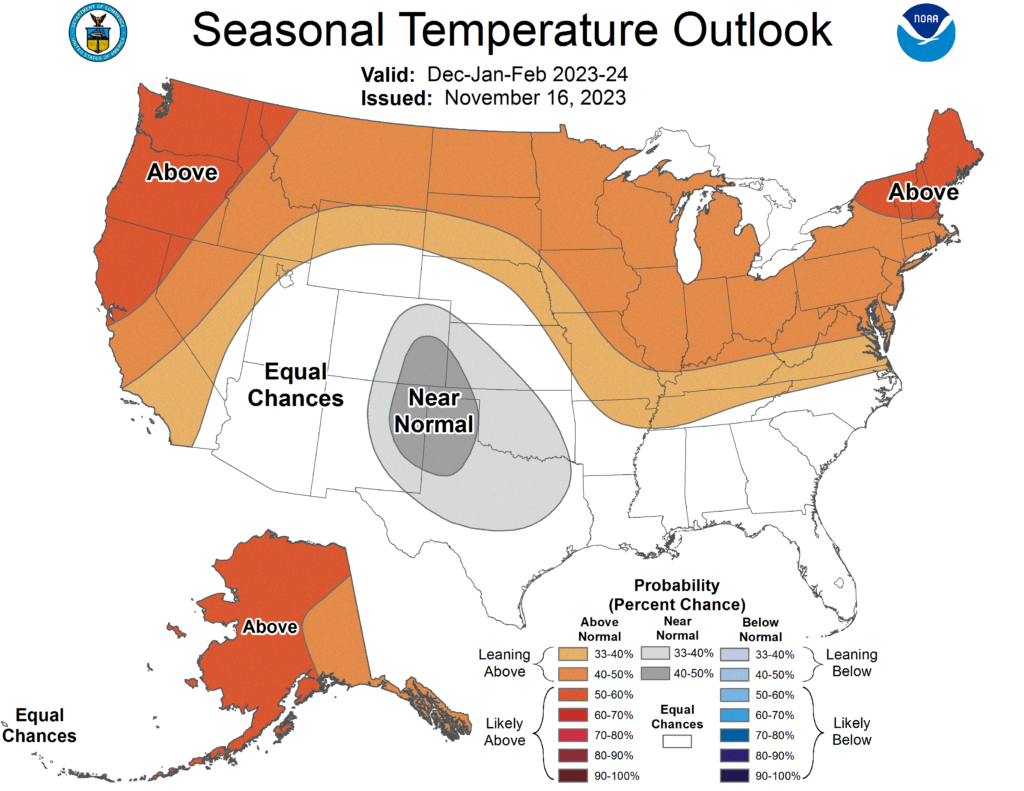

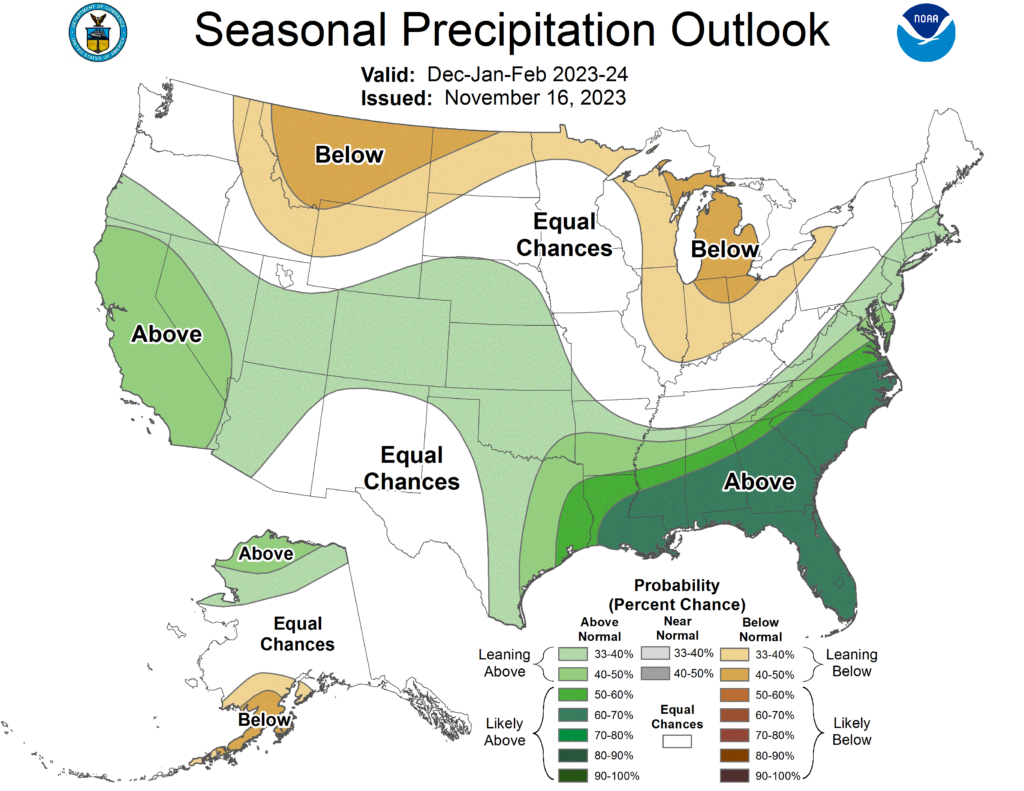

The near-term forecast suggests milder weather, often linked to El Niño December, and reduced bullish pressures from global LNG prices. However, caution flags fly high with the lurking possibility of severe cold, a concern emphasized in the recent NERC Winter Reliability Assessment.

Algonquin City Gates witnesses a notable dip in natural gas futures, echoing a trend of supply growth outpacing demand. Winter 2023-24 contracts bear the impact of mild weather and increased Mid-Atlantic supplies. Although European natural gas (NG) Storage is currently healthy, the lack of domestic sourcing there leaves the continent vulnerable to drastic price increases from extreme winter weather. Because both Europe and ISO – NE are tied to global LNG pricing, the European situation continues to add a layer of complexity in the form of risk premiums for NE energy consumers.

NERC’s Winter Reliability Assessment assures sufficient generating capacity in New England. However, a chink in the armor lies in the inadequacy of natural gas transportation infrastructure, raising red flags for energy emergencies in extreme weather. The Inventoried Energy Program steps in, offering financial incentives for generators to maintain on-site energy inventories.

Despite positive outlooks, the specter of severe cold remains. In this scenario, ISO-NE faces challenges in ensuring continuous power supply as heating demand squeezes natural gas pipeline capacity. Prices could surge significantly higher than the current $91/MWh strip for Winter ‘23/’24 (December ‘23 to Mar ‘24).

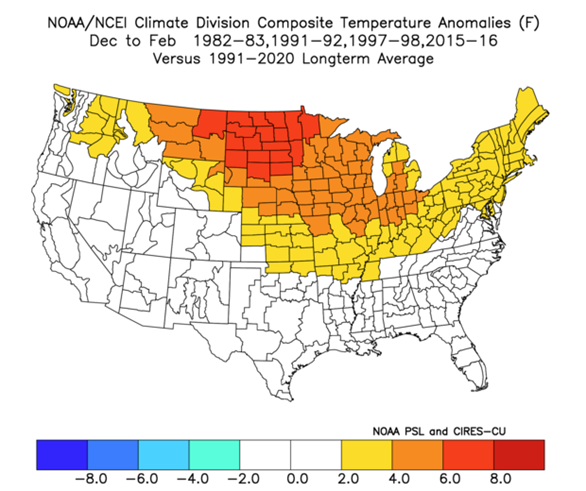

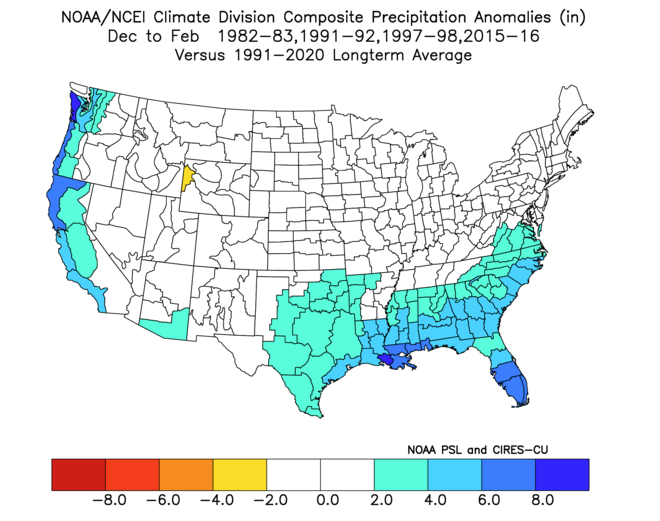

Monitoring weather conditions such as El Niño is crucial for understanding and predicting potential impacts on weather and climate patterns around the world. During El Niño, the usual atmospheric and oceanic circulation patterns are disrupted, leading to various impacts on weather and climate. These impacts can include temperature anomalies and disruptions to normal climate conditions. Precipitation changes aren’t always affected, as you can see in the graphic below. In some regions, El Niño can bring warmer and drier conditions, while in others, it may lead to increased rainfall and cooler temperatures. The specific effects depend on the geographic location and the strength of the El Niño event.

Environ’s market experts stay up-to-date to help you make the best energy decisions. Contact us today to connect!

As New England navigates these complexities, an understanding of the interconnected dynamics of weather, natural gas, and infrastructure is crucial. While immediate prospects seem stable, the energy landscape is a realm of uncertainties, demanding vigilance and adaptive strategies.

Winter Woes and Forward Capacity Auction Delays:

ISO-NE’s move to postpone Forward Capacity Auction 19 by a year to revamp the capacity market underscores the complexity of the region’s energy dynamics. The years associated for the Forward Capacity Auction 19 are 2028 and 2029. This delay allows a deeper study into shifting to a seasonal capacity auction and altering the time lag between the auction and the capacity year. Notably, changes in Resource Capacity Accreditation from resource-specific modeling to a fleetwide winter accreditation value could impact the value of firm gas supply for individual generators.

Read more about winter predictions here.

Offshore Wind Coordination and Economic Pressures:

Collaborative efforts between Massachusetts, Connecticut, and Rhode Island in a joint Memorandum of Understanding for offshore wind procurement aim to enhance coordination and economic attractiveness for developers. However, Connecticut’s recent Request for Proposals with inflation adders up to 15% signals mounting financial pressures. These setbacks pose significant challenges to ISO-NE’s offshore wind outlook, potentially delaying clean energy goals.

Strategic Recommendations:

In light of these uncertainties, end users are advised to adopt a near-to-medium term portfolio procurement approach and actively de-risk Cal 2025 requirements. While extended downside is probable in the immediate term, the severity of upside risks in very cold weather suggests risk-averse end users should actively manage exposure. Structural fundamentals imply more downside potential into Cal 2024.

Risks on the Horizon:

Risk premiums for Winter 2024-25 and Cal 2025 could surge if the Everett LNG terminal closes, New England Clean Energy Connect faces delays, or offshore wind development encounters setbacks. Despite current pricing being more than $20/MWh below last year’s outcome, careful risk management remains crucial for end users navigating the evolving energy landscape.

As FERC, NERC, and ISO-NE grapple with these challenges, Environ Energy stands ready to guide end users through the intricacies of the changing energy panorama. Stay tuned for more insights into the ever-evolving energy panorama.

Understanding the information at deeper level:

1. What is ISO-NE?

The ISO-NE, or Independent System Operator New England, is an independent, non-profit organization responsible for overseeing the high-voltage power grid and wholesale electricity market in the New England region of the United States. It was established to ensure the reliable operation of the region’s power system, facilitate competitive markets, and plan for the region’s long-term energy needs.

Key functions of ISO-NE include:

- Grid Operation: ISO-NE operates the power grid in real-time, ensuring that the electricity supply matches the demand. They balance the flow of electricity, maintain grid stability, and respond to unexpected events such as equipment failures or changes in demand.

- Market Facilitation: ISO-NE administers the wholesale electricity markets, where generators sell electricity to retailers. These markets include the energy market, capacity market, and ancillary services market. ISO-NE ensures fair competition, transparency, and efficient market outcomes.

2. What is the Federal Energy Regulatory Commission (FERC):

Nature: FERC is an independent regulatory agency within the U.S. Department of Energy.

Jurisdiction: It regulates the interstate transmission of electricity, natural gas, and oil. FERC also reviews proposals for energy infrastructure projects.

Key Functions of the FERC include:

- Regulation: FERC regulates the transmission and wholesale sale of electricity and natural gas, ensuring fair rates and competitive markets.

- Infrastructure Approval: It approves the construction and operation of interstate transmission facilities, pipelines, and hydroelectric projects.

- Market Oversight: FERC oversees wholesale electricity markets, promoting competition and preventing market manipulation.

- Collaboration: FERC collaborates with NERC to develop and enforce mandatory reliability standards for the power grid.

- Emergency Response: FERC has emergency authority to address threats to grid reliability and can take action to address emergencies.

3. What is the North American Electric Reliability Corporation (NERC)?

NERC is a nonprofit organization responsible for ensuring the reliability of the North American bulk power system. It operates in the United States, Canada, and parts of Mexico.

Key Functions of the NERC include:

- Reliability Standards: NERC develops and enforces mandatory reliability standards for the planning and operation of the bulk power system.

- Assessment: NERC assesses the reliability of the grid, identifies potential risks, and develops strategies to mitigate those risks.

- Education: It provides training and educational resources to industry professionals on grid reliability.

- Standard Development: NERC works with stakeholders to develop and enforce standards that address various aspects of grid reliability, including planning, operations, and critical infrastructure protection.

- Monitoring and Enforcement: NERC monitors compliance with reliability standards and can enforce penalties for non-compliance.

- Collaboration: NERC collaborates with FERC and other entities to address emerging reliability challenges and enhance the resilience of the power grid.