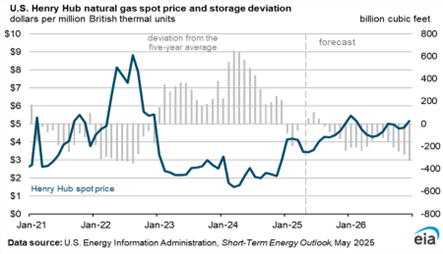

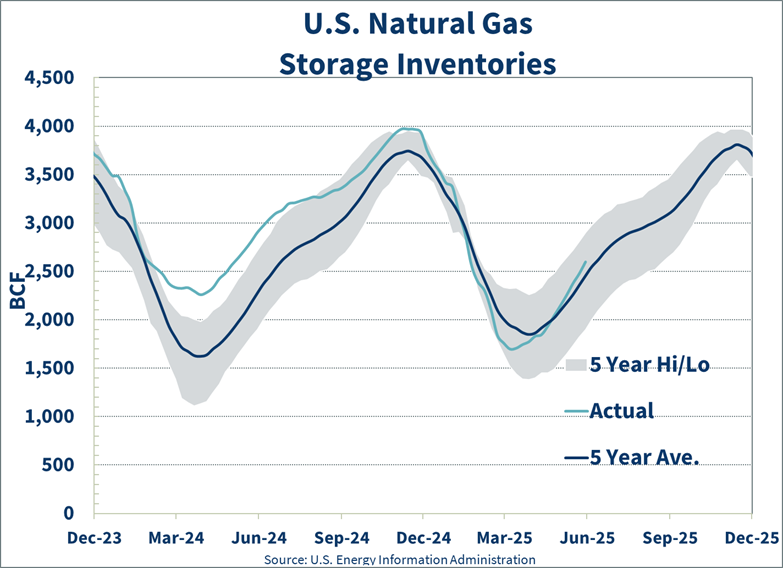

As we begin to enter the summer months, speculative trading throughout the week and low liquidity on Fridays will start to emerge in the market. U.S. NG storage sits above the 5-year average by 93 BCF but still sits 316 BCF below this time last year. Projections suggest that the combination of natural gas demand and LNG exports will outpace our production levels for the remainder of 2025.

Unfortunately, there are not many factors that could allow for there to be market relief. Barring economic turmoil, markets are likely to increase over the next couple months. If we see the tariff proposals get lifted, we could see pricing increase rather rapidly due to more positive economic sentiment.

Gas Outlook

- Demand and exports are expected to outpace supply for the next two years.

- Storage is near the five-year average but remains well below the more comfortable levels seen last year.

- Natural gas markets are still backwardated, with 2026 trading close to highs and 2028 close to lows.

Power Outlook

- We expect price increases to occur as summer approaches.

- There are potential reliability concerns in ERCOT due to the possibility of heat waves this summer.

- The Northeast and MidAtlantic could experience heat waves in July and August, which may lead to reliability concerns and expensive spot pricing, particularly in urban zones.

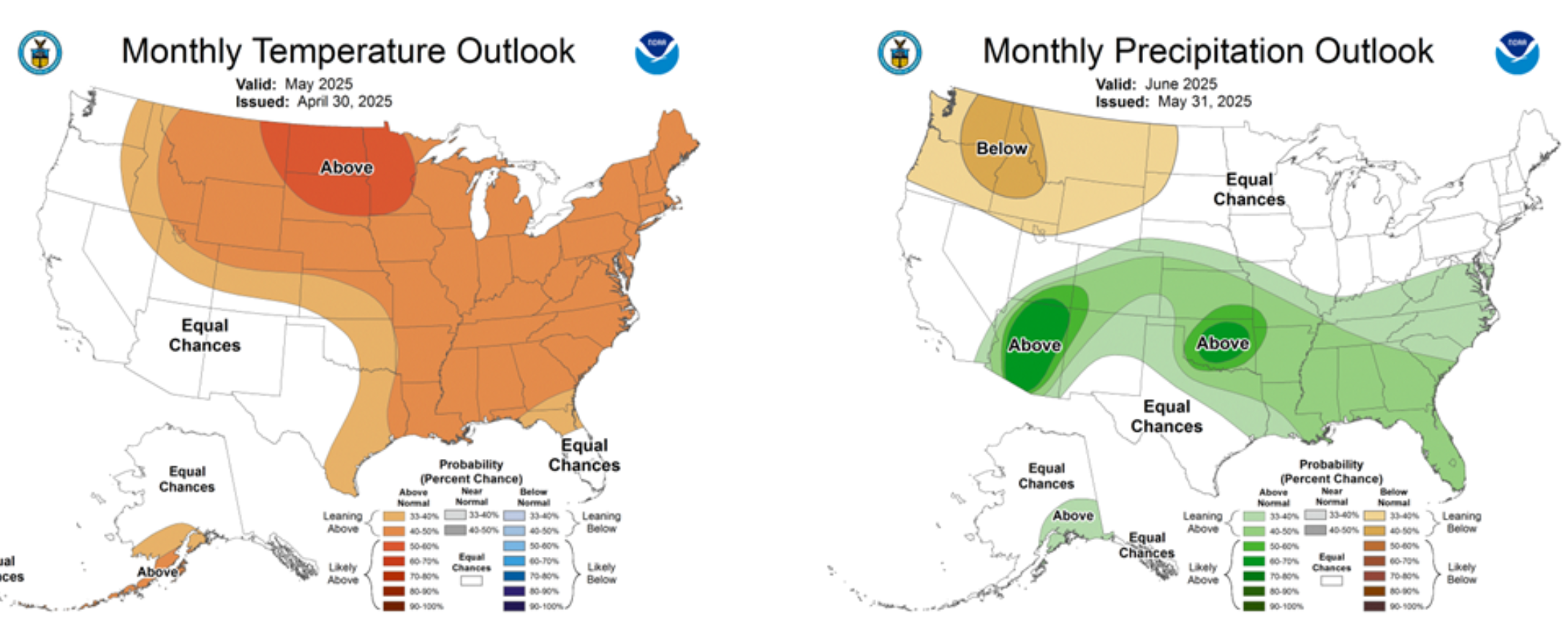

Driving Prices Higher

A combination of factors is influencing the energy market as we move into summer. Speculative trading activity is intensifying due to approaching warmer weather, and forecasts for Summer 2025 point to increased energy demand. In June, there is a high potential for heat waves in the South driven by higher-than-average temperature and humidity levels. July and August are expected to bring similar heat wave risks to the Northeast and MidAtlantic regions, while drier conditions out West may elevate the risk of wildfires.

Simultaneously, U.S. LNG exports are at all-time highs and continue to climb as new facilities come online. March 2025 exports reached 14.8 BCF/D, with Plaquemines beginning exports in December 2024, Corpus Christi Stage III following in February 2025, and Golden Pass scheduled to begin exporting in late 2025. However, production growth is not keeping pace with this rising demand—production is expected to increase by only ~2 BCF/D from 2025 to 2026, while export levels are projected to grow by ~3 BCF/D in the same period. Tariff activity has also impacted the market. Initially, tariff announcements triggered economic pessimism and fears of a potential U.S. recession, which softened energy markets. However, many markets became oversold and saw a corrective increase over the past month. If tariffs are lifted entirely, a shift in economic sentiment could drive prices up rapidly. Adding to the volatility is geopolitical unrest, which has caused short-term price spikes or “noise.” For instance, Ukrainian drone attacks on Russia this past weekend—and the potential for retaliation—highlight the unpredictable nature of these influences. While the EU no longer relies on Russian natural gas, an escalation in the Russia/Ukraine conflict could still introduce significant market volatility.

Driving Prices Lower

Mild spring weather has reduced immediate demand, and natural gas storage levels have recovered to sit above the 5-year average. However, projections indicate that storage may fall below the 5-year average during the summer and remain in deficit through the winter. Despite this potential tightening, the factor with the greatest potential to significantly depress energy markets is an economic downturn, which could sharply reduce demand and exert downward pressure on prices.

Preparing for a Tight Summer Energy Market

As summer approaches, natural gas markets are facing a tightening outlook driven by rising demand, record LNG exports, and limited production growth. While storage remains slightly above the five-year average, it lags significantly behind last year’s levels. Persistent market backwardation and potential tariff shifts could amplify price volatility. In the power sector, heat wave risks across ERCOT, the Northeast, and MidAtlantic raise concerns about system reliability and price spikes—especially in urban zones. Continued monitoring of economic signals and weather trends will be key as market pressures build.

Environ Market Analysts track and analyze millions of data points to help you reduce exposure to market swings, lower energy costs, and prepare for long-term price stability. For localized market analysis or information on scheduling an energy audit, email info@environenergy.com.