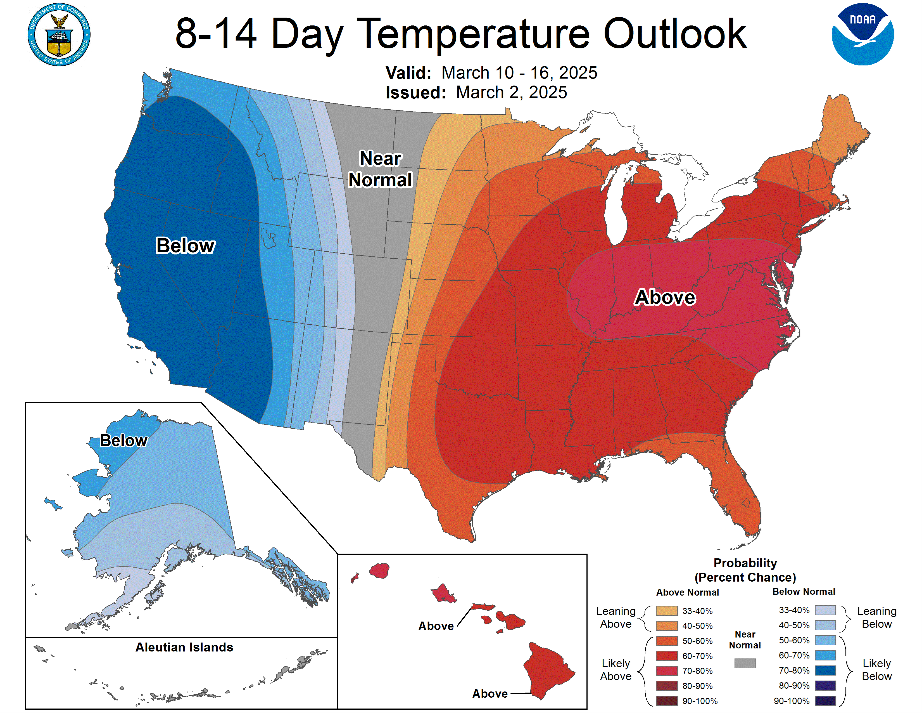

The coldest winter period in over a decade has continued to push gas and power prices higher throughout February. Meanwhile, U.S. LNG exports have reached record levels of 15.6 billion cubic feet per day (Bcf/d), further tightening supply and adding generation risks across U.S. power grids, particularly in PJM.

While bullish risks persist across energy markets, longer-term price relief remains available. In particular, we are seeing attractive buying opportunities in 2027 and 2028 for NYMEX, ISO-NE, and CAISO.

Gas Outlook

- The coldest winter period in over a decade has continued to push prices upward.

- U.S. natural gas storage remains below the five-year average.

- Natural gas markets are heavily backwardated, with 2028 trading near three-year lows.

- U.S. LNG output hit a new record of 15.6 Bcf/d in February.

Power Outlook

- California electricity pricing remains very attractive, with prices for 2026, 2027, and 2028 near three-year lows.

- Potential tariffs on Canadian energy, offshore wind halts, and steel imports are putting upward pressure on pricing.

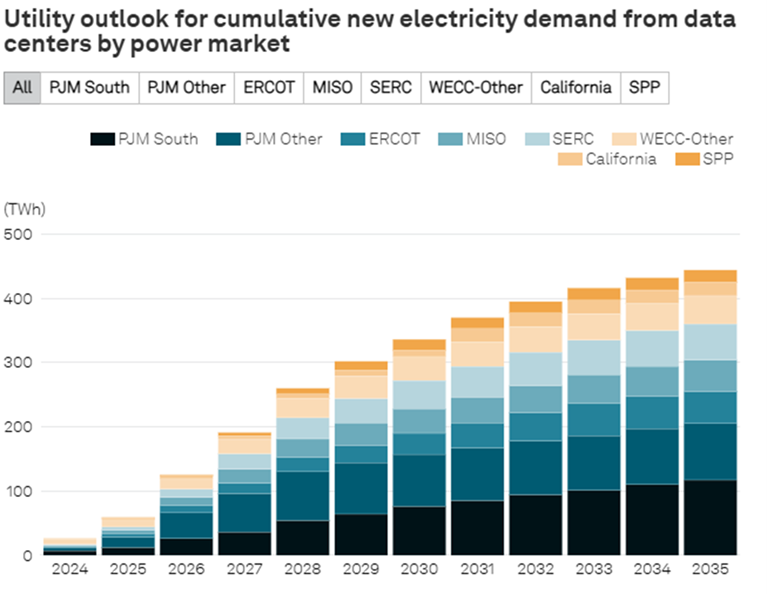

- Load growth is still expected to outpace generation over the next two to three years.

Driving Energy Markets Higher

The persistent cold weather throughout January and February has pushed U.S. natural gas storage levels below the five-year average for the first time since 2022. This supply constraint, coupled with record-high LNG exports and uncertainty around Russian gas flows into Europe, has continued to apply upward pressure on energy prices. Additionally, European natural gas storage levels are now 5% below the five-year average, increasing global demand.

Driving Energy Markets Lower

U.S. natural gas production remains high, helping to offset some of the winter demand surge. Additionally, lowered demand forecasts for data centers—driven in part by Microsoft canceling leases and potential utility miscalculations on expected load growth—may ease pressure on power markets. Furthermore, while short-term cold weather has supported prices, March forecasts have trended warmer in recent weeks, signaling potential relief ahead.

Preparing for Future Energy Market Volatility

The combination of extreme cold, record LNG exports, and ongoing supply concerns has created a complex energy pricing landscape. As heating demand rises and power grids experience strain, prices will likely remain elevated in the short term.

For businesses, understanding the impact of these market shifts is crucial. Reviewing current energy contracts to avoid renewals during peak pricing periods can help mitigate cost increases. Participating in demand response programs can also lower energy usage during periods of high grid stress, leading to significant cost savings. Additionally, scheduling an energy audit can help identify efficiency improvements that reduce long-term energy expenses.

Environ Market Analysts track and analyze millions of data points to help you reduce exposure to market swings, lower energy costs, and prepare for long-term price stability. For localized market analysis or information on scheduling an energy audit, email info@environenergy.com.