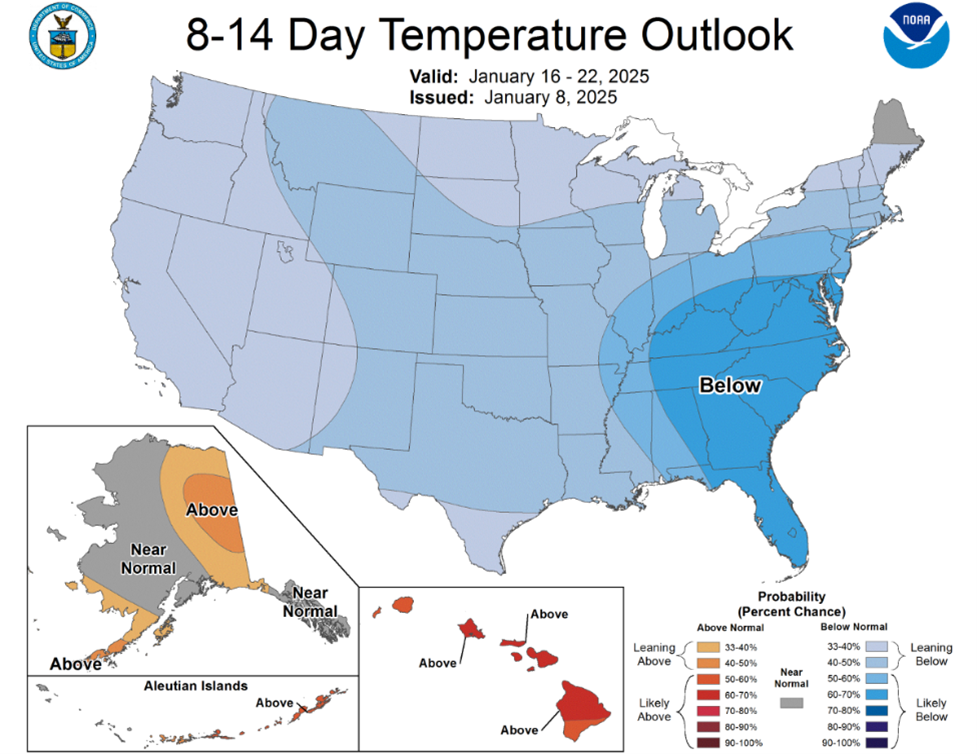

Winter weather has firmly settled across the United States, creating heightened energy demand and impacting market trends. Cold temperatures are expected to persist, leading to continued upward pressure on natural gas and electricity prices.

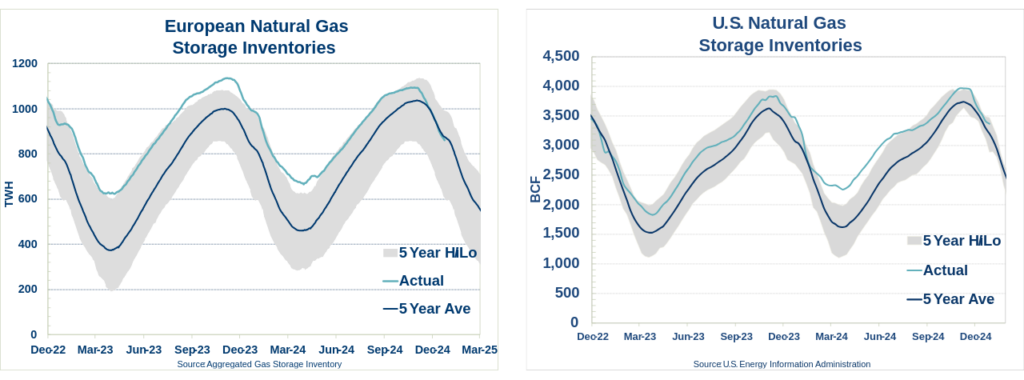

In Europe, similar weather patterns have led to the fastest depletion of natural gas storage in over seven years. Weather concerns paired with Ukraine halting flow of Russian natural gas to Europe has pushed pricing up.

Gas Outlook

- Persistent cold weather is driving increased demand across the U.S.

- Domestic natural gas storage remains above the 5-year average, providing some cushion against short-term demand spikes.

- 2025 prices have surged 10% in the past month, while 2026 prices have seen a 3% increase.

- LNG (liquified natural gas) exports remain robust, driven by Europe’s rising demand amid storage challenges.

Power Outlook

- U.S. power demand is projected to rise by 128 GW over the next five years, underscoring the importance of renewable generation development to meet demand growth.

- Energy shortages remain a concern, with SPP and ISON facing risks as early as 2025.

Driving Prices Higher

The ongoing cold weather across much of the United States has led to significant increases in energy pricing, particularly for 2025 contracts, which have rebounded sharply from prior market lows. Ukraine cutting flows of Russian gas to Europe has caused higher pricing in New England & New York City. Meanwhile, Europe’s natural gas storage levels have fallen to 5% below their 5-year average, intensifying global competition for liquefied natural gas (LNG) and further contributing to upward market pressure.

Driving Energy Markets Lower

Despite the colder weather, U.S. natural gas storage levels remain above their 5-year average, providing a critical buffer against demand spikes and helping to stabilize prices. Additionally, delays in several U.S. LNG export projects have relieved some pressure on domestic inventories, keeping supply levels healthy. Looking ahead, weather forecasts for February and March suggest milder conditions, which could help ease market volatility and potentially drive prices lower as winter progresses.

Get Your Organization Ready for Energy Price Volatility

Winter energy markets rely on proactive strategies to minimize costs. Begin by reviewing your energy contracts to ensure they don’t expire during peak pricing periods, as renewing during these times can lock in higher rates. Demand response programs, energy audits, and shifting energy-intensive operations to off-peak hours can all help reduce your exposure. Additionally, investing in energy-efficient technologies, such as upgraded HVAC systems or LED lighting, can lead to long-term savings by reducing overall consumption. It’s also important to monitor market trends regularly to identify opportunities for cost-saving measures and risk mitigation.

Environ Market Analysts track and analyze millions of data points to help you reduce exposure to market swings, lower energy costs, and prepare for long-term price stability. For localized market analysis or information on scheduling an energy audit, email info@environenergy.com.