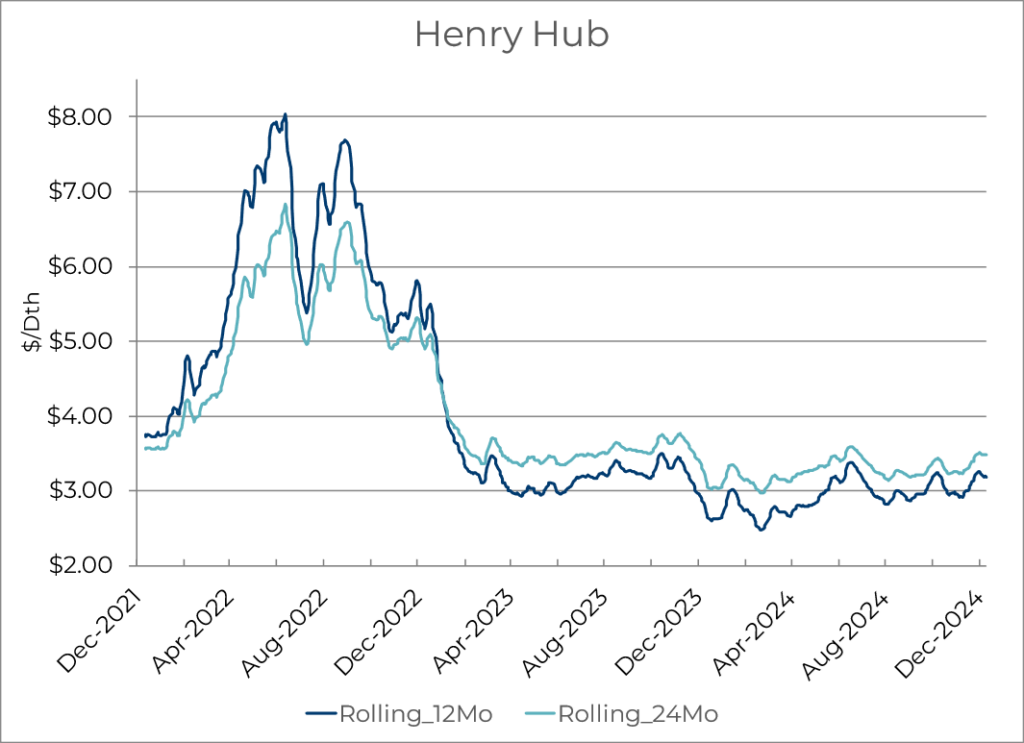

Colder weather and increased demand has pushed pricing up slightly over the past week. Despite the uptick, power and gas pricing across the country remains favorable for 2025. Global markets have come off a bit over the past 2 weeks as geopolitical tensions and demand have curbed slightly.

Bearish

- Natural Gas production Increase

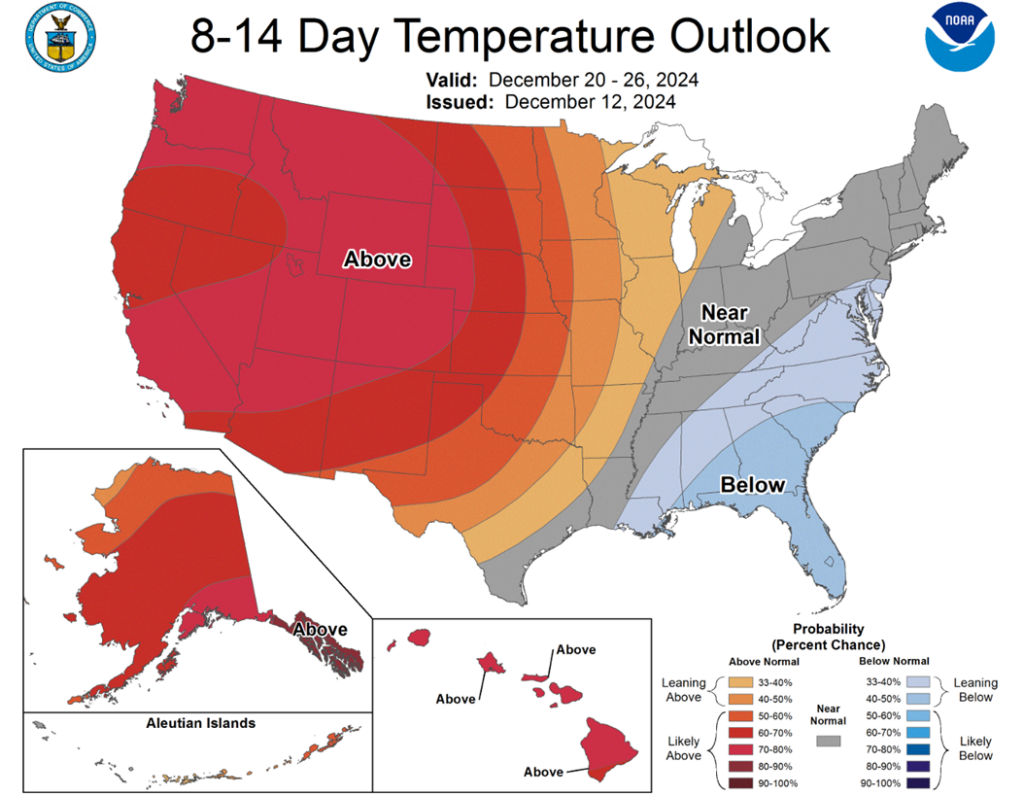

- Weakened La Nina forecast

- Warmer 6 to 10 day outlook from NOAA

- Natural Gas storage is right near the five-year high for this time of year

Bullish

- European storage levels

- Cold Weather

- Lower renewable energy output

- Short term cold front

- Increased gas demand for power generation

- Data Center demand growth

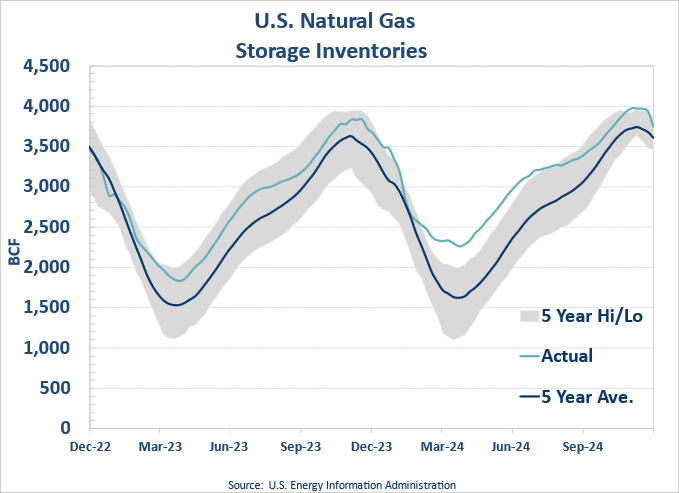

Storage Report 12/12/2024

Expected Withdrawal: 173 BCF

Actual Withdrawal: 190 BCF

Current Storage Level: 3,747 BCF (4.6% above the 5-year average)

Initial projections suggested a smaller withdrawal this week. Actual withdrawal came in almost 20BCF higher than expected. Colder weather swept across the majority of the country this previous week contributing to a higher-than-expected storage pull.

NOAA MAP

Regional Dot Plots

Rolling 12/24 Gas Curve

Environ provides this bi-weekly market report covering high-level market conditions to all of our procurement clients. Contact us for localized market analysis and recommendations.