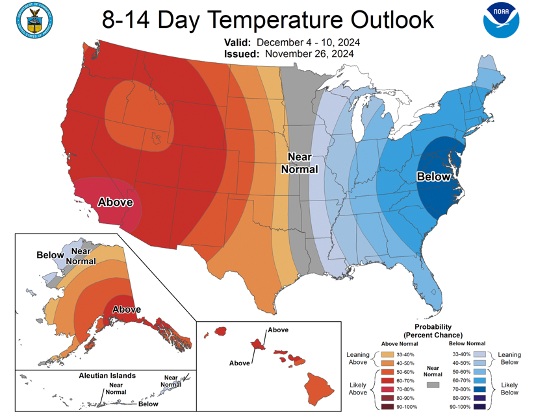

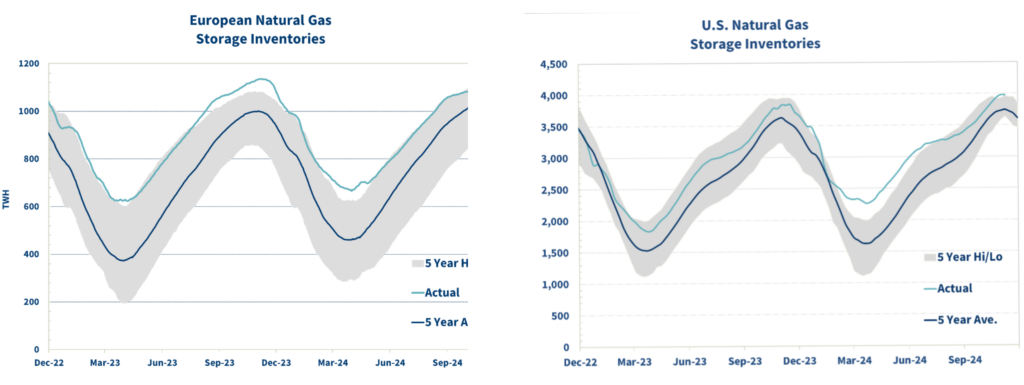

It is now that time of year where energy markets tend to be volatile. NOAA’s near-term weather outlooks suggested colder than average temperatures over the next couple of weeks, causing significant upward movement in the market, despite natural gas storage being at 5-year highs.

Escalations in the Russia/Ukraine conflict have reignited concerns over Europe’s natural gas supply. Russia shut off their pipeline flow to Austria, which could increase Europe’s demand for liquified natural gas (LNG) this winter. If the U.S. ramps up their LNG exports, we may have less natural gas supply domestically. Being that many regions of the country are reliant on burning natural gas to generate electricity, we could see rising markets for both natural gas and electricity.

Gas Outlook

- Storage levels are setting 5-year highs.

- Winter 2024-2025 pricing has dropped from $3.34 to $2.80 over the past two weeks.

- Potential short-term increase in demand for LNG (Europe).

- Power demand and LNG export growth pushing demand higher and could raise prices in the future.

Power Outlook

- Race between demand increases (LNG exports, data centers) and renewable generation moving through the interconnection queues.

- Markets have crept up due to winter weather.

Driving Energy Markets Higher

The onset of winter weather has caused 2025 pricing to quickly increase from last month’s market lows. Additionally, geopolitical escalations have caused temporary increases to both power and gas markets. Europe has tapped into a substantial amount of their natural gas storage already as they were hit with colder weather. Another factor driving up energy prices is the increased demand for natural gas from LNG exports and power generation across the US from data centers and EV’s, which has kept 2026 and beyond pricing higher.

Driving Energy Markets Lower

As winter forecasts become less daunting, the weather could be a factor in driving lower energy prices. Most recent models suggest a 57% chance of a La Nina developing by the end of December. The La Nina is anticipated to be both mild, and short-lived. La Nina’s bring about colder winter weather to the Northeast, the mild winter of last year was fueled by an El Nino. Another factor driving lower energy prices is that natural gas storage levels are currently at 5-year highs, fueled by an “extra” injection on November 8th. In addition, the Golden Pass LNG facility experienced a minor delay into 2026, which could push down futures pricing for late 2025.

Get Your Organization Ready for Rising Winter Energy Prices

An increase in demand for electricity and natural gas in the winter months is typically high. Storms can stress the electricity grid and there’s always a possibility that power generating plants can go offline. As heating demand rises, prices rise accordingly.

It’s important to understand the impact cold weather can cause on your energy costs so you can plan for ways to save. Start by examining your current energy contracts to ensure they are not expiring during the peak of the winter season, when pricing will likely be high. If you can avoid renewing contracts during the peak of winter, you have a better opportunity to lock in lower rates. Consider joining a demand response program, which lowers your business’s energy usage during times of high stress on the electric grid and often leads to significant cost savings. If possible, make sure to run any energy intensive machines during off peak hours such as the early morning to further reduce energy costs.

Another important step in preparing your organization for rising winter costs is to get an energy audit of your facility. This includes a thorough examination of all systems that use energy in your facility, including lighting, HVAC, and more. Most organizations find that upgrading to more efficient systems provides considerable reduction in energy usage, leading to long lasting savings.

Environ Market Analysts track and analyze millions of data points to help you reduce exposure to market swings, lower energy costs, and prepare for long-term price stability. For localized market analysis or information on scheduling an energy audit, email info@environenergy.com.