Natural gas forward strips have rebounded slightly but are still trading right near a 12-month low. Warm weather across most of the US has kept energy prices down, as we have not yet needed to tap into storage to meet heating demand. We are still recommending that customers look to lock up costs for 2025. With a La Nina winter approaching, the northern half of the US could see some prolonged colder spells which will drive up pricing.

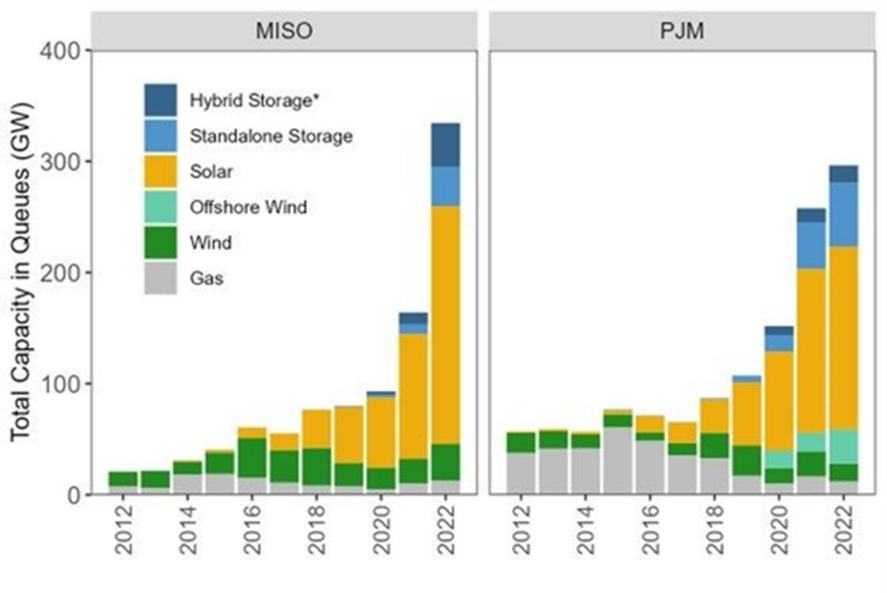

Additionally, power pricing has continued to fall over the past month. We are recommending taking a position for 2025 at a minimum across most ISO’s right now. We are also watching very closely the race between renewable projections moving through the interconnection queue and new demand from data centers and electric vehicles (EVs) across the US. With fossil fuel generation retirements across the US, renewable generation will need to meet the expected demand increases. Unfortunately right now a lot of that generation is stuck behind an interconnection queue. From interconnection queues to capacity markets to environmental regulations pushing old, dirty plants to close, how regulators approach the energy transition will play a big role in determining what resources are available and what prices will do in response.

Gas Outlook

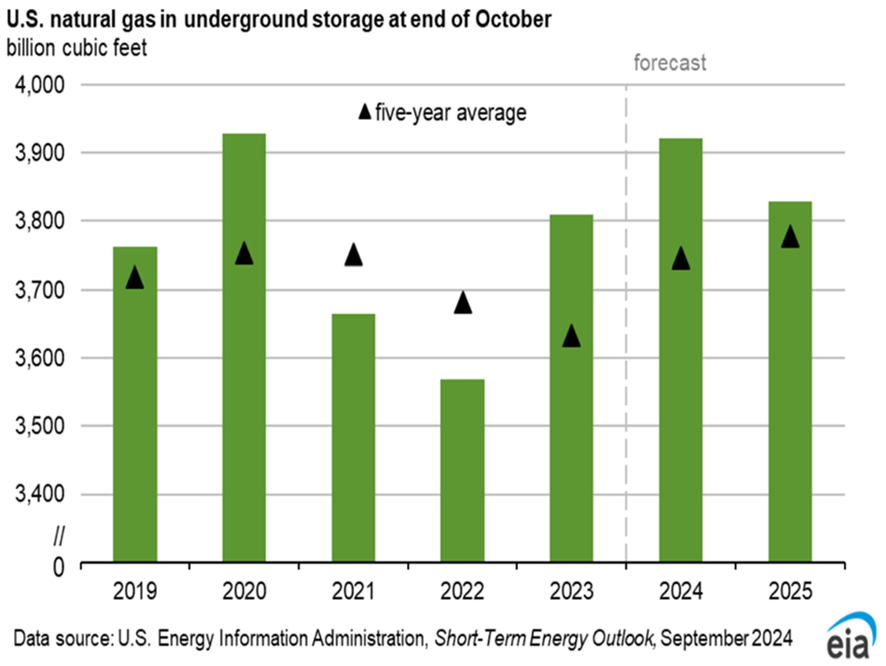

- Back-to-back weeks of greater than expected natural gas injections have kept pricing low.

- Winter 2024-2025 pricing has dropped from $3.34 to $2.80 over the past two weeks.

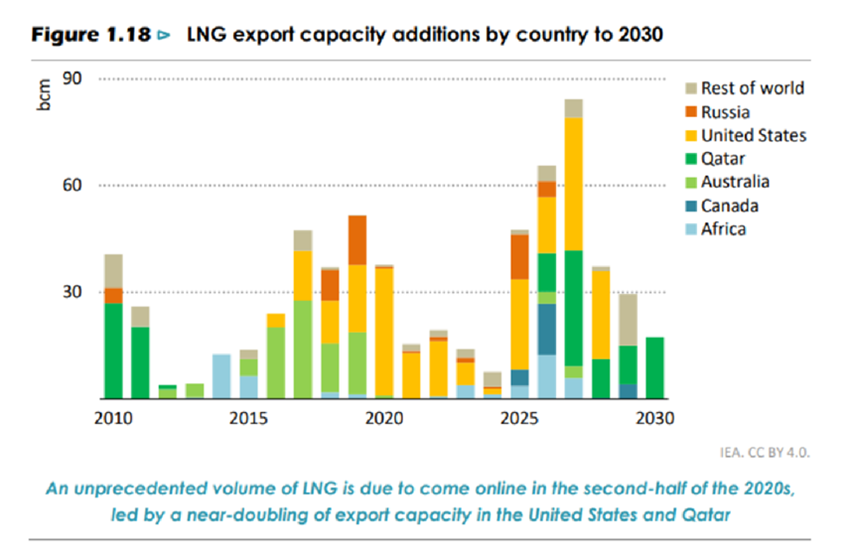

- Power demand and LNG are pushing demand higher and could raise prices in the future.

- The recommendation is to buy gas through at least 2026.

Power Outlook

- Race between demand increases (LNG exports, data centers) and renewable generation moving through the interconnection queues.

- 2025 strip trading is right near 2-year lows.

- Beyond 2025, strips are decreasing but have more room to fall.

Interconnection delays and a pipeline of intermittent renewables will be challenged to meet the growing demand from EVs and data centers.

Driving Energy Prices Higher

While gas and power pricing for 2025 has seen substantial decreases over the past month, pricing for 2026 and beyond is still a bit elevated. Increased demand for natural gas from LNG exports and power generation across the US from data centers and EVs has kept the year’s pricing higher.

As it stands, we are expected to head into next winter with very tight storage levels due to the increased demand, this historically means higher forward and spot pricing. There’s a race between how quickly renewable generation projects can get through the interconnection queue and how quickly demand ramps up. If renewable generation gets held up, we could see big spikes in pricing.

Driving Energy Prices Lower

There are many factors attributing to recent lows in the power and natural gas market. Production has remained relatively stable despite such low prices. After a slower start to injection season, we have seen multiple weeks with larger than expected injections into natural gas storage.

Power prices have also continued to decline over the past month, as the US transitions towards more renewable generation and away from oil, coal, and nuclear. Natural gas for power generation is up across the entire country making the two markets move more closely than ever before in some regions. In ERCOT (The Electric Reliability Council of Texas) we saw renewable generation keep spot pricing lower this summer than it has been over the past 3 summers, this has helped lower outer year pricing as well. Additional factors, such as increased global supply has started lowering pricing in areas of the country that rely on LNG to meet demand in winter months (mainly New England in New York City).

Environ Market Analysts track and analyze millions of data points to help you reduce exposure to market swings, lower energy costs, and prepare for long-term price stability. For localized market analysis and recommendations email info@environenergy.com.