What is Capacity?

Capacity is an electricity bill cost component intended to ensure the grid has enough power generation to meet the needs of consumers during times of absolute peak demand. In some electricity contracts capacity is bundled together with other line items, but it can also be passed through as a separate, stand-alone charge.

Because capacity is intended to help prepare the grid for the future, capacity auctions are run in advance of when the capacity will be needed. Depending on the market, you may know prices six months ahead of time or four years beforehand. Each region of the US differs in their nomenclature and timelines, but some generalities hold across regions: Capacity years typically run from early summer in one year to late spring the next year (and they may have additional seasonality built in). Capacity prices influence energy bills, revenue from demand response programs, and even you returns on efficiency projects. As such, contracting poorly for capacity can cost you some of the benefits of any efficiency improvements you make. Even if you’re in an area that doesn’t have capacity costs, our contracting experts will help you identify how to structure a contract to maximize your protection.

Below we offer a quick update on four capacity markets around the US.

MISO

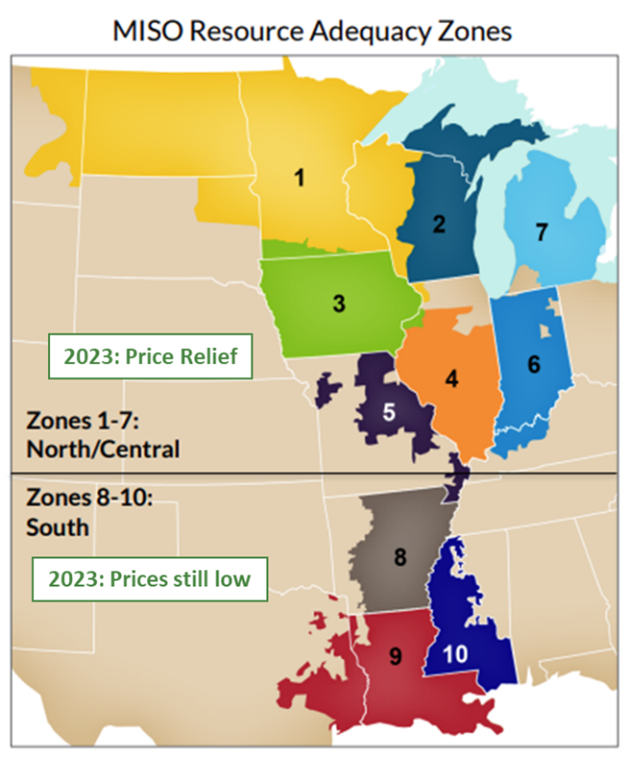

MISO capacity prices have been extremely volatile over the past several years. For the 2020/21 capacity year, Michigan prices cleared very high, and a 1 MW customer would pay $100k/year compared to about $2k/year in all the other regions. The following year, all zones cleared at very low prices, but again in 2022/23, prices cleared at their extremely elevated levels for the northern 7 zones. At the most recent auction for 2023/24, prices plunged back down.

The reason for the price volatility has to do with how MISO runs their auction. MISO sets a generation requirement for a given auction, and then power plant operators “offer” their availability by participating in the auction. If a zone has enough generation to meet their requirement, the auction clears at a very low price. If a zone does not, then prices clear at “cost of new entry” prices in order to incentivize new generation additions to the grid. MISO has been exploring changes to how they structure their auction, but the considered changes are minor and unlikely to remove this binary “high vs. low” dynamic. Therefore, customers should expect capacity prices to remain volatile for the foreseeable future.

PJM

Traditionally, PJM has run their auctions a few years in advance. However, in 2018 PJM decided to pause their auctions to address questions of participation requirements and penalties for non-performance. Five years later they still haven’t resolved those questions, specifically on what it means for a generator to be “reliable.” And so, the capacity auctions have been regularly delayed. In June 2023, it was announced that PJM’s next capacity auction (for PY 25/26) would be delayed until June 2024. In part this extra time will allow PJM to continue working to define “reliability.” But PJM has also stated they need this extra time to study potential load growth and anticipated powerplant retirements in their region.

While these delays are not a good look for PJM, their credibility took an additional hit in their most recent auction where PJM decided, after the auction, that because the clearing price for one zone was too high they would artificially lower it. They chose to do so because they changed their estimate of how much generation was needed based on the results of the auction. However, this retroactive change sets a bad precedent that will linger in the minds of generators. PJM is certainly facing big challenges, and perhaps they are identifying inadequacies in capacity markets generally. But for markets to be effective, strong constructs need to be established and competition should be allowed to determine which generators can offer the service in the most cost effective manner.

ISONE

Early in 2023, ISO-NE ran their capacity auction for their 2026/27 capacity planning year, giving power producers and customers insight into capacity prices roughly three-plus years into the future. High capacity prices often lead to increased scrutiny on operations while lower capacity prices can reduce the financial benefits of participating in certain grid programs (like Demand Response). But as you can see from the graph, since energy rates can move separately from energy prices, lower capacity prices doesn’t always mean low total costs and vice versa.

The capacity price trend for ISO-NE is roughly flat for now. After capacity prices spiked in the 2018/19 CCP, prices fell consistently for the next 5 auctions until the 2023/24 CCP. The 23/24 was the bottom of the market, as the known prices for 24/25, 25/26, and 26/27 are all above the 23/24 prices customers are enjoying now. Still, we won’t be revisiting the extreme spike of a few years ago, as all known future prices are near or below the 22/23 CCP that we’ve just transitioned away from. Generally, capacity is expected to be a calm line item for the next few years in the region.

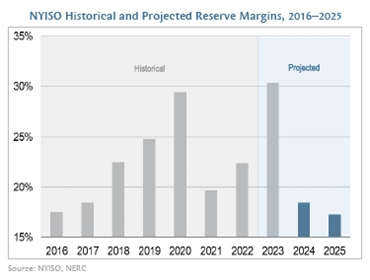

NYISO

Capacity prices in NYC this summer have increased nearly 250% from a year ago. NYC has the highest rates in the state due to several policy choices the state has made and is continuing to make. One important policy is the Department of Environmental Conservation’s Peaker rule, whose goal is to reduce ozone pollution. This rule will impact approximately 3,300 MW of electricity generation between 2023-2025 by retiring fossil fuel based resources. These policies are expected to create volatility in the capacity market. NYISO has expressed concerns over these policies too rapidly shifting the energy grid, which will likely cause increases in capacity and transmission costs. Although capacity prices are going up, resource adequacy for this summer is not a concern. Forecasts show the state will have over 41,000 MW of power generation capacity available to meet the forecasted power demand of 32,000 MW, which leads to a 28% reserve margin. However, in the next couple of years more resources are expected to go offline than online, which leads to dwindling reserve margins in 2024 and 2025. Lower reserve margins will also lead to higher capacity prices to incentivize new assets to be built.