A Guide to Solar Energy for Businesses

We frequently hear from our clients something along the lines of “I want to understand my options for solar energy for businesses.” For some, they read an article about falling costs and want to find savings. Others get pressure from stakeholders to pursue (or at least quantify) the potential benefits of solar. The “why” behind the desire for solar will influence which type of program would work best.

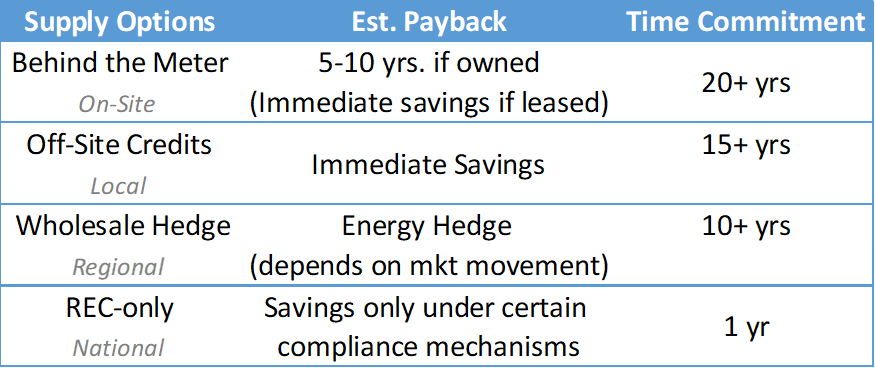

Additionally, your solar energy options will also depend on your location. Each of your facilities will be subject to state and utility incentives and regulations governing the available options. The table below is directionally accurate, but it’s almost certainly not a perfect fit given your particular situation. However, it is an excellent framework through which you can start to understand your renewable energy options.

In this blog, we’ll go in-depth into each of these options to help you determine which would best suit your company.

SEE MORE: How Solar Power Has Improved Over Time

Behind the Meter (BTM)

BTM solar is solar installed on your property. This typically takes the form of Carport or Rooftop solar, but the solar infrastructure could be located in an adjacent field or on some other structure near your facilities. The electrical tie-in is behind your utility meter, so when the sun is shining, the solar power generated flows directly to your campus, and the effective power you pull from the utility is reduced. This is a great option for buildings expected to be around for a long time (even if the ownership structure changes).

You often face the choice of purchasing or leasing the panels. While purchasing the solar system tends to offer better returns, there is typically a large initial capital outlay. This outlay is softened by federal tax incentives, which were recently improved and expanded upon (now available to nonprofits!) via the Inflation Reduction Act of 2022. However, it still takes years to recoup your investment. In contrast, leasing the system often provides immediate cost relief and tends to be the more commonly-chosen option. This is usually done through a Power Purchase Agreement (PPA).

Because these are long-term agreements, one of the most essential elements of the lease agreement is the price escalator. PPAs with large escalators (2% or more) can look good initially but create significant long-term cost exposure for your organization. It’s important to analyze the pricing assumptions that go into these projects rigorously.

Off-site Credits

Each state uses different terminology and acronyms, but a handful of states allow for off-site solar facilities to generate “bill credits” that can be applied to your electricity bill. We see strong interest in states where this option exists, especially from clients who expect to own and operate their existing buildings for decades. (Possible terms for this structure include Community Solar and Virtual Net Metering.)

Under these bill credit programs, your savings are typically determined by a discount tied to some moving rate. For example, you may save 10% off whatever the utility’s rate is. If the utility’s rates go up, you save more; when the utility’s rates drop, you save less. But you’re always guaranteed to have savings. This guaranteed-savings model makes off-site credit programs a very desirable option.

The biggest element to consider when entering these agreements is the size of the commitment you make. Since you’re committing to using a certain amount of energy for a long time, you’ll want to make sure you don’t buy more bill credits than you’ll be able to use in 5, 10, or 15 years – especially if you plan to pursue efficiency and energy reduction measures aggressively.

Wholesale Hedge

These options work best for large energy users (typically >40,000 MWh annually). You can buy electricity from very large solar farms that intend to sell the power directly into wholesale markets. You agree to purchase solar energy at a specific price, but the savings of this approach will depend on what the underlying wholesale market does. If the comparable wholesale market price goes up, you report savings; if the market goes down, you report a loss. But instead of looking at it from a savings/loss perspective, it’s much better to think of this structure as an energy hedge.

For energy users on third-party supply (available in deregulated markets), this wholesale structure will look nearly identical to how you already purchase and hedge electricity. The only change is that the power source will be specified as being from a particular solar facility.

Suppose the energy is purchased from the wholesale market where your facilities are located. In that case, you’re buying a physical Power Purchase Agreement (PPA) since the power will be delivered to your physical facilities. The agreement is settled on the power bill. Suppose the energy is purchased in a different wholesale market than where you operate. In that case, this structure is often called a virtual Power Purchase Agreement (VPPA), and the settlement of the power becomes a separate financial transaction.

RECs

With each of the above options, it is important to clarify what happens with Renewable Energy Credits (RECs). When you buy electricity generated by an array of solar panels, you cannot claim to be buying “renewable,” “clean,” or “green” power unless you also obtain the REC associated with the energy you’re using.

When the RECs and the power are sold together, this is called a “bundled” PPA (the RECs are bundled with the power). When RECs are sold separately, they are called “unbundled” RECs. You can buy unbundled RECs to claim you’re using renewable energy, but this represents an additional cost to your organization. Thus, it’s impossible to justify savings with this method. (One exception is when you face a regulation target that provides various compliance alternatives; in those cases, buying RECs may be less expensive than another alternative, such as a fine.) One benefit of buying unbundled RECs is that the timeframe is very short. You can quickly achieve “clean power” and greenhouse gas emissions reduction goals while you separately pursue more cost-effective solutions for the longer term.

In all situations, it’s essential to ensure clarity around whether you retain rights to claim the RECs from a solar project or whether those RECs will be monetized separately by the developer. The treatment of RECs in the contract impacts what environmental statements you can make and will affect the project’s financial performance as well.

Do you want to learn more about adding solar power to your business? The experts at Environ will devise a solution tailored to your application. Contact us to discuss the options that would work best for your specific situation.