A Look At How to Gauge the Cost of Carbon on the Environment

There are many cascading effects of adding carbon dioxide to our atmosphere. One commonly understood chain may go something like this: Increased CO2 leads to increased temperatures, which leads to melting ice caps, which leads to sea level rise. There are many such chains and scientists spend years studying the nuances of each. For instance, sea level rise is partly due to melting ice caps (more water) and partly due to thermal expansion (warmer oceans take up more volume than colder ones even if the amount of water stays the same).

Just like there are many different cause-and-effect chains in natural systems, there are cause-and-effect chains in our social systems too. Some of them are relatively straightforward: Sea level rise may lead to increased human migration (especially from low-lying Pacific Island nations). However, others are a bit less intuitive: increased CO2 may actually improve our agriculture by increasing crop yield. Overall the main takeaway is that there are real economic consequences to each element of how CO2 emissions impact our world.

That’s why economists established a metric measuring the social cost of carbon. What is the social cost of carbon and how is it relevant for your business? In this blog we explain what it is and look into alternative costs of carbon to help you better understand your business costs and prepare you for any future legislation.

SEE MORE: Environ Energy Acquires Carbon Analytics Leader Scope 5

The Challenge in Evaluating the Cost of Carbon

Perhaps the biggest challenge to addressing climate change is that the net cost of carbon impacts isn’t actually paid by those who emit the carbon. The cost of emissions is borne by society at large, whereas the benefit is concentrated. As an example, look toward electricity. The benefits are limited to a rather narrow group – the one(s) using the electricity, along with the one(s) getting paid for the generation and delivery of that electricity. But the cost of the carbon this generation emits isn’t directly paid by any in that group. Thus, the question: what is the social cost of that carbon?

When a cost or a benefit is incurred by a third party, economists call this an externality. And economists can represent these externalities in dollars; they add up all of the costs and benefits of emitting a little bit of CO2 into the atmosphere and calculate a dollar value for the additional CO2. This value is called the Social Cost of Carbon. (In economics-speak, this cost represents the marginal cost of CO2 emissions. Those who care deeply about the economics perspective will also want to understand how discount rates can alter this cost, but that is outside the scope of this blog.)

Social Cost of Carbon

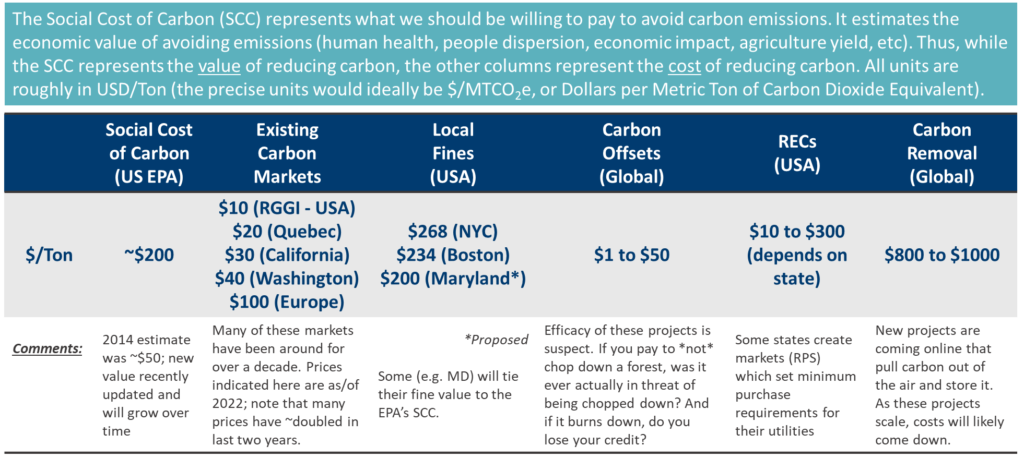

The Environmental Protection Agency (EPA) is updating their suggested Social Cost of Carbon (SCC). The SCC is expressed in $/ton, and it is an attempt to represent the whole economic burden placed upon society for emitting one ton of carbon. This number is used by various government agencies when they are required to do certain cost-benefit analyses for proposed actions.

The EPA under Obama initially estimated the SCC to be roughly $50/ton, but the EPA is now considering a number closer to $200/ton. (Some academics argue the number may be even an order of magnitude higher.) In addition to being used by government agencies, some states (e.g. Maryland) are looking to this number to help them set a price on emissions. Additionally, companies and organizations use this number internally in their accounting to better estimate their true cost of doing business and prepare for any potential “price of carbon” legislation.

The impact of the SCC will vary depending on the use case. For instance, if you’re already powered by renewables, implementing a SCC wouldn’t really change the price of your electricity. But the grid is powered by a mix of renewable and fossil-based fuels. So what would be the actual social cost for your company? If the market mix stayed the same and we applied a SCC of $200/ton, electricity prices would increase by approximately $50/MWh (varying greatly by location). Natural gas prices would increase $10/Dth and oil prices would increase $2/gal ($90/BBL).

Calculating the Cost of Carbon

The SCC is not the only approach to pricing carbon. Ultimately, your business may have to deal with various methods depending on where you’re located:

- Cap-and-Trade: A regulating body sets emissions targets and then distributes “permits to emit” to various industry participants. Those who are below their targets can sell their excess permits to others who are over their allowance. This structure lets market forces organically set a price for emissions, but only the “excess” emissions are priced, not the emissions that make up the baseline. Many existing carbon markets (e.g. RGGI in the US and Europe’s approach) mirror this framework.

- Local Fines: City or state legislations (like BERDO) use more of a Cap-and-Tax approach; they set the amount of emissions and charge a set fee for emissions above that amount. Again, this only prices carbon above certain emission thresholds.

- Carbon Offsets: Conceptually, this is similar to a cap-and-trade market, except it’s entirely voluntary. Carbon offsets typically represent someone voluntarily reducing carbon and then selling that carbon reduction to another party who gets to claim the reduction. (A word of caution: The efficacy of many offsets is questionable, and a buyer should be discerning to ensure their claims match the reality of the offset they are procuring.)

- RECs: There are markets for renewable energy credits (RECs) that place a value on the environmental benefit of producing electricity from renewable sources. The cost per carbon of these RECs will depend on the cost of the REC (which varies by state) and the emissions of the local grid that this renewable energy is displacing.

- Carbon Removal: Carbon Dioxide Removal, or CDR, represents the technology-based cost of a project that extracts emissions directly from the atmosphere. Essentially, it’s a really big fan blowing air over a very specialized filter designed to pull out CO2.

Note that many carbon prices are rising around the globe. So while all of these costs are subject to change, here is a rough snapshot of prices as of Q4 2022:

Note that some tax structures will also put a price on carbon. In the US, there is a 45Q credit for storing carbon underground, and this value is increasing from $50 to $85 per ton. Unfortunately, this credit is often claimed by oil companies who get the credit when they push carbon underground in order to aid in the extraction of more fossil fuels, which makes this tax credit a bit misguided in its application.

Ultimately, the consequences of carbon emissions are global — carbon emitted anywhere is felt everywhere. Therefore those who have the ability to act have a greater obligation to do so. Whether you want to begin accounting for an internal cost of carbon to understand your impact or are concerned about meeting current or pending regulations, our team would be happy to continue the discussion with you. Fill out our contact form to learn more.